RAPTOR

Directly connect to Asia-Pacific venues (FIX + Native) with ultra-low latency, while complying with all trading risk requirements.

New

Two Products to Meet Your Business Needs

RAPTOR

<12 microseconds one-way latency

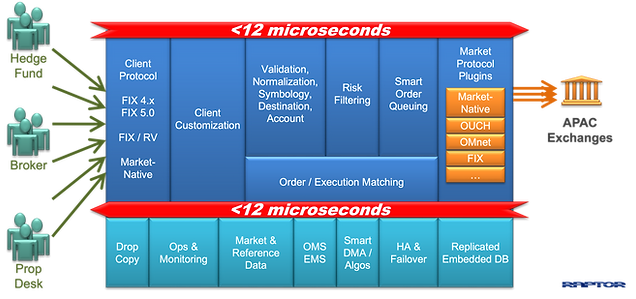

Raptor is an ultra-low latency market gateway and pre- post-trade risk management solution, providing investment banks and proprietary trading firms with both FIX and market-native Direct Market Access to equities and listed derivatives exchanges.

Raptor combines client connectivity, comprehensive risk management, and market connectivity, all in one platform - including smart DMA, advanced order types, order routing, protocol conversion and order state management. Raptor includes a full set of industry-standard risk filters, incl. inventory and margin collateral checks.

Raptor provides session termination, with the ability to share exchange sessions amongst clients. There are no limitations to the number of incoming client and outgoing exchange connections. Raptor provides a one-way latency of <12 microseconds including pre-trade risk checks.

Raptor’s command and control app, called Flux, enables electronic trading desks, risk managers and network operators to perform order management interventions, risk control, connectivity and alert management, and network system health monitoring. Raptor supports a range of flow management, monitoring, operations, logging, integration and trading intervention features.

Raptor’s Smart Order Queuing function allows market connections to be flexibly allocated to clients via pools, each connection being a member of multiple pools (virtual bundles). An active Raptor instance will automatically load balance multiple connections to the same venue. Raptor uses a proprietary adaptive queuing algorithm that maximizes aggregate throughput, even if individual connections are rapidly varying in latency.

Raptor is a fault-tolerant high-availability system that is deployed as a cluster, consisting of a primary, secondary and optional DR instance.

RAPTOR FPGA

<200 nanoseconds one-way latency

Raptor FPGA is a market-native hardware-accelerated solution for co-located Direct Market Access and pre-trade risk management. Raptor FPGA is used by investment banks and proprietary trading firms that require direct communication with equities and listed derivatives exchanges using market-native interfaces, with the lowest latency.

An application-specific FPGA PCI-Express accelerator card is installed in each Raptor FPGA server along with Raptor FPGA specific controller software. The accelerator card is used to offload latency-sensitive message processing from the standard Raptor software and thereby reduce latency.

Pre-trade risk filters reject breaching orders by removing them from the client→market flow and inserting rejects in the market→client flow, preventing any trading disruptions due to market rejects or disconnections. Raptor FPGA provides a full set of industry-standard risk filters, incl. inventory and margin collateral checks.

Raptor FPGA does not violate restrictions on sponsored access – is not a network bridge/router

-

Client-side network and market-side network are strictly segregated

-

No direct network-level connectivity between client-side and network-side

-

Ethernet/IP Level – client side is a separate VLAN and IP network from the market side

-

All messages are parsed, risk-filtered, individually processed as necessary and forwarded

Raptor FPGA’s command and control app, called Flux, enables electronic trading desks, risk managers and network operators to perform order management interventions, risk control, connectivity and alert management, and network system health monitoring. Raptor supports a range of flow management, monitoring, operations, logging, integration and trading intervention features.

Raptor FPGA is deployed as a fault-tolerant pair of x86 Linux servers (2U each) running 64-bit Linux, each with a Raptor FPGA PCI-E card attached to the PCI-E bus. There are no limitations on the number of client and exchange connections, with the ability to connect multiple clients to the Raptor FPGA PCI-E card.

Raptor FPGA is often combined with an Arista 7132LB low-latency switch (or equivalent) for fan-in and fan-out. Trading flows enter and exit the Raptor FPGA PCI-E card within 200 nanoseconds including pre-trade risk checks.

Smart Order Queuing Module

New

Raptor’s Smart Order Queuing (SOQ) module, combined with our low latency market gateway and risk management solution, intelligently times order release at pre-market open in order to increase the likelihood of earliest possible entry at market open. This provides the ability to send orders during the pre-market open period, Raptor manages those orders and then triggers the sending of those orders at an optimized time prior to market open. The functions include:

-

Low latency FIX/native-in -out exchange connectivity layer

-

Hold specific orders received before market opens

-

Modify / cancel / reprioritize orders held in the queue

-

Trigger the sending of orders at an optimized time, accurate to +/- 2 microseconds

-

Leverage multiple market lines to submit queued orders simultaneously

-

If an order is rejected, resubmit repeatedly until accepted and within configured parameters

-

Adapt behavior according to how close to breaching the exchange reject rule (exchange specific). Actively track and prevent the maximum number of rule breaches from occurring

-

Turn on/off SOQ at Raptor instance level

Lowest Latency

Raptor provides the lowest latency in Asia-Pacific, and is one of the only solutions that guarantees performance.

Our team believes that latency performance should be transparent, hence full in-bound and out-bound per-message latency data is available in drop copy. In addition, latency analysis can be performed on a per-market, per-client and per-symbol basis, while latency analysis reports can be provided to customers on request.

Full Commercial Transparency

-

Simple and transparent commercials. Raptor is priced as an unlimited usage license per exchange connection, with no limitations on the number of clients, servers, Raptor instances, flows, orders, volume, etc.

-

Software support is included in the Raptor license. This includes 1) access to new Raptor releases 2) registration of new feature requests 3) defect remediation for Raptor releases

-

Full support for mandatory exchange upgrades are included within the Raptor license

Business Use Cases

Our customers use Raptor both as a tactical and/or strategic solution, depending on their business and customer requirements.

We have customers who already use an in-house platform, and view Raptor as a more tactical solution, such as to:

-

On-board a low-latency customer within a fast time-to-market

-

Quickly facilitate trading to a currently unsupported exchange

-

Meet risk regulations for specific exchanges

-

Respond quickly to major exchange upgrades

On the other hand, we have customers who use Raptor region-wide as their default Asia-Pacific exchange gateway and centralized risk management platform, viewed as a fast, proven and low-cost solution.

Raptor supports agency, prop and swap-settled order flows.

Resilient Technology

Raptor supports multiple exchanges throughout the Asia-Pacific region, facilitiating normalized market access. Raptor integrates cleanly with existing in-house systems and real-time market data platforms.

Raptor performs exchange connectivity using optimized implementations of native exchange protocols at maximum speed, and does not utilize any third party software libraries or code.

Raptor installs on standard Intel / Linux servers that meet the specifications of the required performance level. Raptor is fully fault-tolerant against all single points of failure including network, hardware and software.

Ease of Deployment

Raptor has four well-defined integration points that form the basis of every implementation:

-

Market data

-

Reference data

-

Client connectivity

-

Drop copy

Our experienced implementation teams can deploy Raptor in 2-3 months (depends on detailed requirements for integration, customization and exchange connectivity). Full local support is provided for client onboarding and testing for go-live.

Our Managed Service delivery applies best practices:

-

Capability Maturity Model (CMM) & IT Infrastructure Library (ITIL)

-

Adherence to change and incident management processes

-

APX (Adaptive Project eXecution) is optimized for agile solution delivery to dynamic enterprises